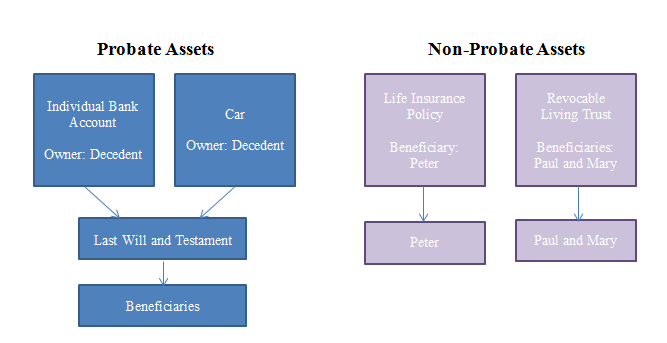

In order to prepare your estate plan, you need to know that your assets can be put into two categories: probate and non-probate assets. Once you understand the difference between these two types of assets, you will be able to make informed decisions about how you wish to distribute your property to your loved ones.

Probate refers to the process by which a court determines whether a person’s Will is valid. It is also used to describe the administration of a person’s probate estate once the validity of the Will has been established. This includes tasks such as accounting for estate assets, paying any debts or taxes owed by the estate, and distributing the remaining assets to the beneficiaries of the estate.

Probate assets are assets owned by a deceased person (the “decedent”). They will pass to the beneficiaries named in the decedent’s Will (or, if the decedent did not have a Will, to his or her heirs under state statute). Examples of probate assets include:

- Personal property, such as jewelry and furniture

- Bank and brokerage accounts owned solely in the decedent’s name that have no beneficiary designation

- Real property owned solely by the decedent or an interest in real property owned by the decedent as a tenant in common

- Life insurance policies that list either the decedent or the estate as the beneficiary

By contrast, non-probate assets have a survivorship feature or a beneficiary designation. As a result, this type of property does not pass to beneficiaries through the probate process. Instead, the property can immediately flow to a designated person or entity. Examples of non-probate assets include:

- Real property owned in joint tenancy with a right of survivorship

- Bank accounts with POD (payable on death) or TOD (transfer on death) beneficiaries

- Retirement benefits with beneficiary designations such as 401(k), IRA, 403(b), profit sharing plans

- Life insurance policies that list someone other than the decedent as the beneficiary

- Property held in a trust

Your Will does not control the distribution of non-probate assets. Therefore, you need to identify these assets and coordinate their distribution with the provisions of your Will. The ability to distribute assets outside of the probate process offers several advantages. First, it allows named beneficiaries to avoid the time and expense associated with probate. Instead, they will have access to your assets immediately upon your death. If you own property in multiple states you can avoid going through an ancillary probate process in those states (See this article for additional information about ancillary probate).

Avoiding probate is also useful if you think someone might contest your Will. Some non-probate assets are also protected from a decedent’s creditors. For example, life insurance policies are not usually subject to claims against a decedent’s estate as long as the decedent or the estate is not named as the beneficiary on the policy. If the decedent, the estate and is some states the Living Trust is named as the beneficiary on a life insurance policy, this would make the proceeds from the policy probate assets subject to creditors of the estate.

Understanding the differences between probate and non-probate assets will allow you to create a more individualized estate plan that addresses your specific goals and concerns. For example, you can turn some probate assets into non-probate assets and gain greater control over what happens to your assets upon your death and, in some cases, your incapacity. This can give you peace of mind and make things easier for your loved ones after you are gone.

Understanding the Duties of an Executor in Probate of an Estate